Closing Costs When Buying a Home

What You Need to Know

Closing costs when buying a home are a fact of life. They are a part of every real estate transaction. While buyers cannot avoid these significant fees, they can ask the seller in the contract offer to cover some or all on settlement day. However, before going this route, there’s plenty buyers need to know. Allow us to break it down.

What Are Closing Costs?

Closing costs are expenses over and above the purchase price of your new home, paid at settlement. They include attorney fees, escrows, title search, title and homeowners insurance, taxes, and your lender’s costs. Some of those costs are charged by your state or local government and cannot be negotiated. Others can be part of the negotiation process, which we will address below.

Closing costs vary according to the size of your mortgage and taxes in your jurisdiction.

In our area, buyers should budget about 3% of the home’s purchase price for closing costs.

Of course, this could be higher or lower depending on the exact jurisdiction and the type of loan you select. Sellers have their own closing costs they are responsible for paying.

Closing Cost Assistance

Buyers sometimes can receive help from the sellers with paying their closing costs. Most often, this assistance happens with properties under $700,000 and with FHA and VA loans. Buyers can ask sellers to allow them to essentially raise the home’s sales price to cover a settlement day closing cost credit. Whatever number you request in closing cost assistance is effectively deducted from the net proceeds to the seller.

A buyer’s offer of $510,000 with $10K in closing cost assistance equals an offer to the seller of $500,000 if the seller is covering closing costs.

It’s important to note that your new home must appraise at the full purchase price, including the closing cost credit. Your Realtor will advise you on whether requesting closing cost credit could lead to appraisal issues.

Our Advice

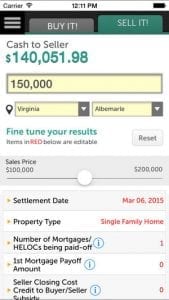

If you do not need it, we do not recommend asking for closing cost assistance, especially in a competitive situation as it can weaken your offer  substantially and decrease the chances of your offer accepted being accepted. If you do want to ask for closing cost help, a specific number must be included in the offer; in other words, you cannot request that the seller cover “half” of your closing costs. Additionally, the amount requested in closing cost credits cannot exceed the actual closing costs (if closing costs are $15K, you cannot ask for a credit of $17K). You can experiment with different scenarios in the app CloseIt!, but if you have any questions about closing costs, you should talk with your lender for the most accurate information.

substantially and decrease the chances of your offer accepted being accepted. If you do want to ask for closing cost help, a specific number must be included in the offer; in other words, you cannot request that the seller cover “half” of your closing costs. Additionally, the amount requested in closing cost credits cannot exceed the actual closing costs (if closing costs are $15K, you cannot ask for a credit of $17K). You can experiment with different scenarios in the app CloseIt!, but if you have any questions about closing costs, you should talk with your lender for the most accurate information.

The Bottom Line

Closing costs when buying a home can be steep! Asking for closing cost assistance can be a wise move in some (not all) scenarios, especially for first-time home buyers. However, if you’re trying to buy in a competitive situation, asking for a closing cost credit will negatively affect your offer. Consult your lender and your Realtor for advice on the best strategy for your situation.

Thinking of buying a new home? It’s never too early to start the conversation and begin planning. Book a buyer’s appointment with us today!

Book a Buyers Appointment

For more real estate advice, be sure you’re getting our weekly blog roundup in your inbox.